While national housing headlines point to a slowdown, the Boise real estate market tells a more local and more layered story.

In May, both home prices and inventory rose across Ada and Canyon counties, which isn’t the first time we’ve seen rising inventory and rising prices coexist.

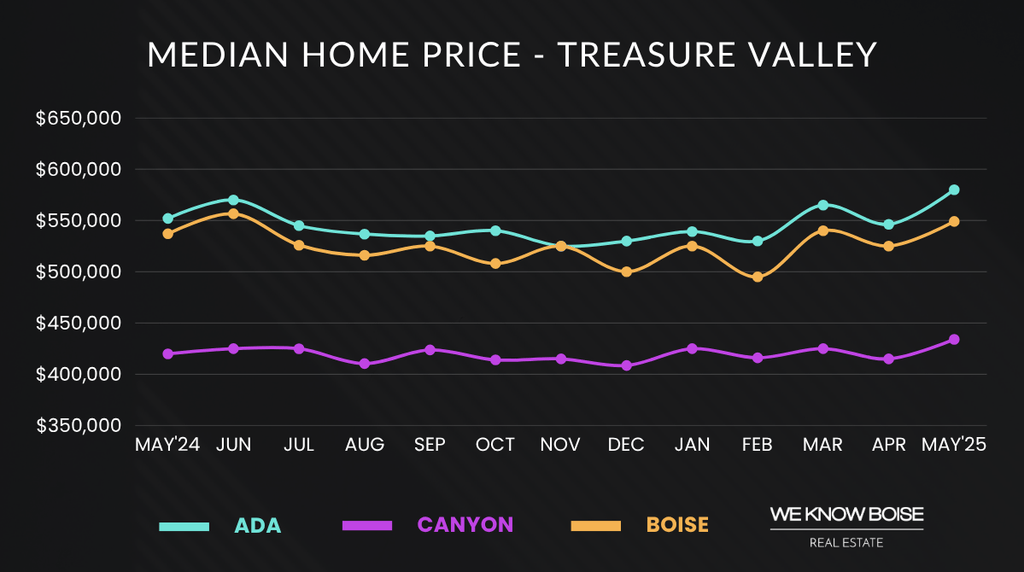

In Ada County, the median sales price climbed to $579,900- up nearly 5.1% from May of last year. Canyon County prices were up 3.4% year over year with a median price of $433,990.

Homes that are priced strategically continue to draw near-full-price offers. In May, sellers in Ada County received 99.64% of their asking price on average; in Canyon County, it was 99.79%.

This “sale-to-list price ratio” reflects how close homes are selling to their original asking prices and it tells us that when a home is priced well, there’s not much room for negotiation. For buyers, it shows that competitive homes still sell close to the list price. For sellers, it underscores the importance of strategic pricing, condition, and presentation right out of the gate.

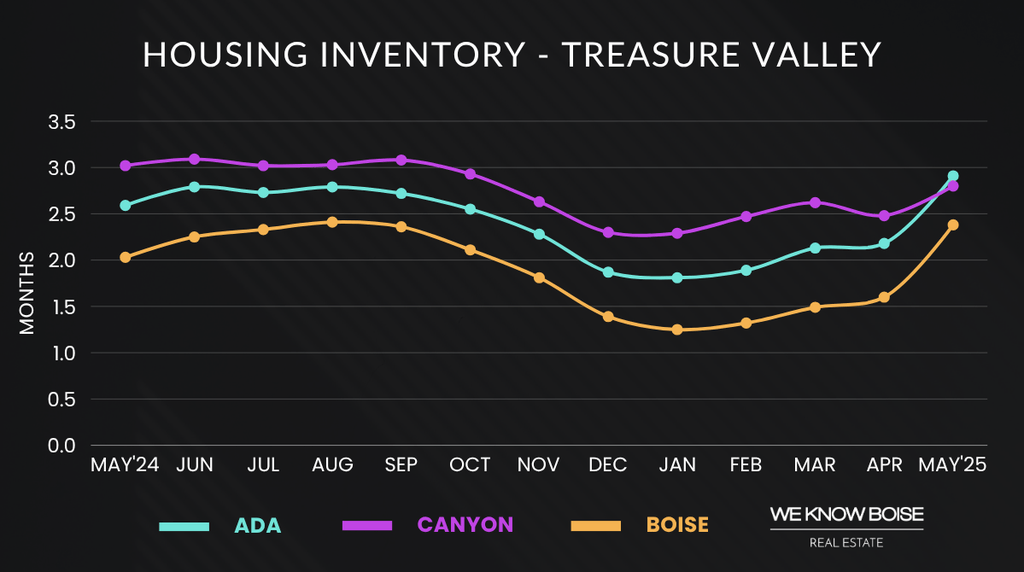

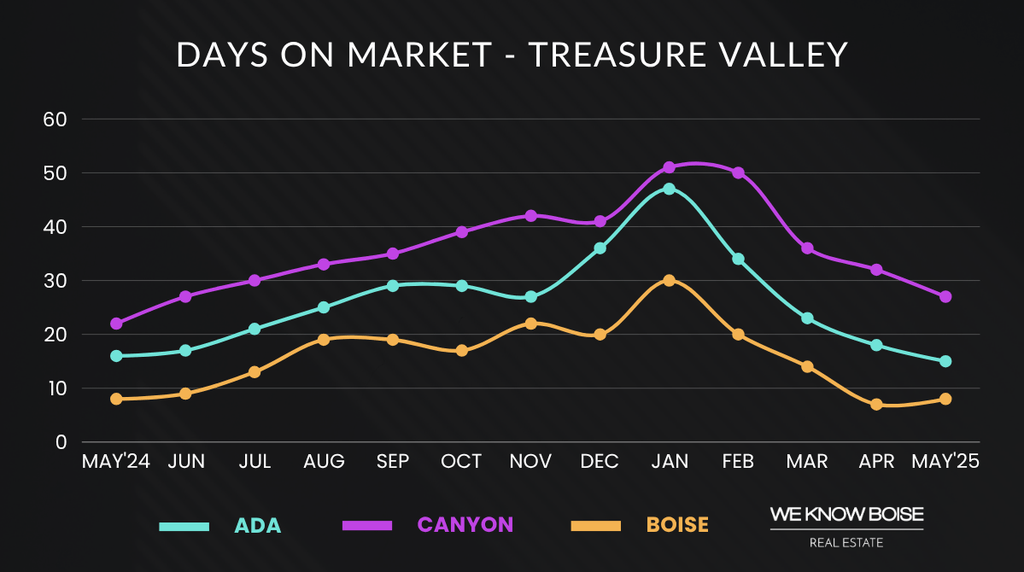

Last month, housing supply continued to grow. Ada County had 2.91 months of inventory, the highest since September 2022 with homes taking an average of 15 days to sell. Canyon County had 2.80 months of supply and a median of 27 days on market.

The total number of pending sales in Ada County reached 1,289 in May, a 7% increase from last year. In Canyon County, the number of pending sales was 796, up 5% from the year prior.

Pending sales can serve as a snapshot of recent buyer behavior. Since most homes go under contract 30 to 60 days before they close, they often reflect activity from the past few weeks rather than past months.

Mortgage rates have remained stable, with the 30-year fixed average hovering at 6.84%. While that’s essentially flat compared to last year, affordability continues to weigh on entry-level buyers. Buyer behavior remains highly rate-sensitive, with activity spiking during even modest rate dips. Some builders are reintroducing rate buydowns on new homes and other incentives to boost traffic, a sign that not all segments of the market are moving at the same pace.

Boise’s market has a long history of absorbing change more steadily than national trends would suggest. We saw a similar pattern in late 2023, with rising inventory and firm pricing. Whether these conditions hold will largely depend on how well the market absorbs rising inventory, especially as we approach the traditionally slower stretch of the late summer season.

By the Numbers: May 2025 Real Estate Market Overview

Median Price: What You Should Know

The median sale price provides a snapshot of home affordability in the market. It represents the midpoint of all home sales, giving buyers an idea of what they might expect to pay. A higher median price typically reflects a more expensive housing market.

Inventory Trends and What They Mean

The number of homes available for sale shows how much choice buyers have in the market. Changes in this number indicate whether inventory is growing or shrinking, which can affect competition and pricing for buyers.

What Days on Market Tell Us About Demand

The average number of days on market measures how long it takes for homes to sell. A lower number suggests a fast-moving market with high demand, while a higher number indicates homes are taking longer to sell, often reflecting lower buyer activity.

Boise Market Trends

- Median list price: $545,000 (up 0.9%)

- Median sold price: $549,000 (up 2.2%)

- Average price per square foot: $322 (up 1.6%)

- Total home sales: 313 (down 2)

- Median days on market: 8 (unchanged)

- Available homes for sale: 2.38 month supply (up 0.35)

- 30-year mortgage rate: 6.82% (down 0.24)

Treasure Valley Market Trends

- Ada County: $579,900 (up 5.1%)

- Eagle: $904,500 (up 4.3%)

- Garden City: $693,550 (fewer than 10 sales)

- Kuna: $469,990 (up 2.6%)

- Meridian: $572,500 (up 4.1%)

- Star: $582,995 (up 6%)

- Canyon County: $433,990 (up 3.4%)

- Caldwell: $416,990 (up 6.5%)

- Middleton: $485,020 (up 3.3%)

- Nampa: $423,870 (up 1.5%)

More From Our Blog

Select information in this We Know Boise market report was obtained from the Intermountain MLS (IMLS) on June 9th, 2025. While the data is deemed reliable, it is not guaranteed. City-specific data refers to single-family homes on less than one acre, whereas county-level data includes homesites of all sizes. The "months of supply" metric is based on a 12-month rolling average. Home prices mentioned combine both existing and new construction properties. Comparisons are based on year-over-year changes unless otherwise specified.